Oil And Gas Investment Calculator

- Posted on April 26, 2022

- Investments

- By Russell Richardson

- 4595 Views

Evaluate Oil & Gas as a Private Investor

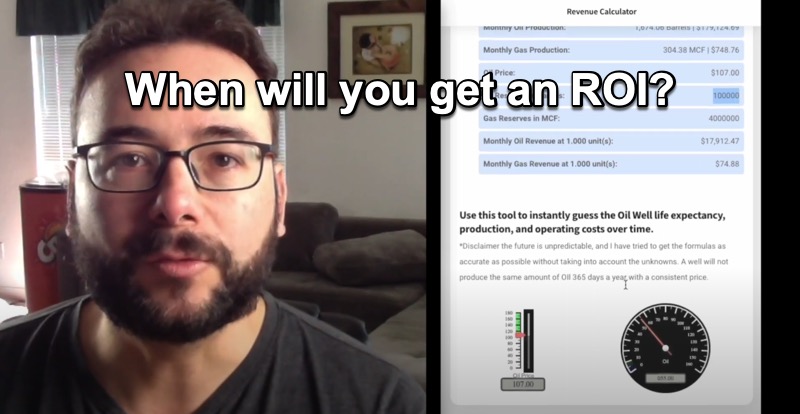

What is the bottom line for your return on investment?

What is the timeframe to recover Oil and Gas?

How much Oil and Gas production would it take to break even on an investment?

When investors can see the potential ROI first-hand by crunching production numbers over the duration of the project; this calculator becomes invaluable.

To become profitable, a Joint Venture should have a large Oil reserve with low production costs. When using an Oil and Gas Revenue Calculator, the investment's crude oil production revenue is used as a baseline to estimate a payout. While we are attempting to predict uncertain outcomes, it's important to recognize that determining the return on investment (ROI) timeline for oil and gas ventures involves both inherent risks and potential benefits.

Calculating NRI, Working Interest, and RI

This calculator will deduct royalty interest and operating costs from potential revenue. Royalty Interest is a passive non-operating, non-participating interest that the land owner does not have to do anything to earn a portion of the production revenue. Drilling, maintenance, and decommissioning are paid for by investors within the joint venture.

As an example, royalty rights holders in a given joint venture investment are entitled to 20% of total revenues and let's say another 5% interest is held by the managing partner or group that operates the drilling equipment. What’s derived from the investment unit after royalties will then be 75%, and if a single party holds the working interest here, this will be the full amount they receive. However, if a joint venture is divided into smaller units, they will divide this 75% into smaller, fractional interests and will be responsible for 95% of the operational and tangible drilling costs.

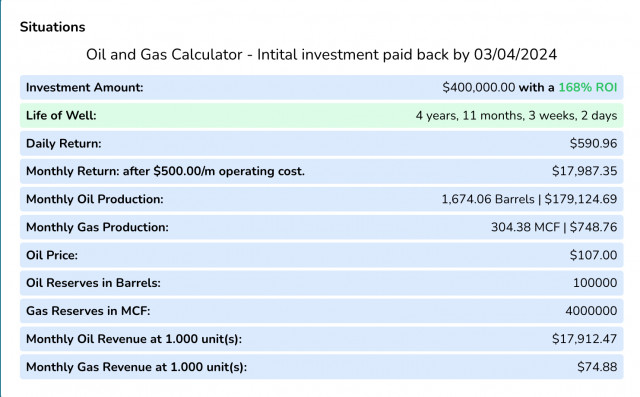

Private Investor Example purposes

Oil investing profits are dependent on a few factors. The size of the reserves, the production costs, and the location all play a role. Will your oil investing project have a natural gas drive? This tool will calculate natural gas produced alongside crude oil production. For example purposes, ROI is based the daily price of oil and natural gas by estimating the daily production of a hypothetical crude oil supply. This production feedback from the investment capital will estimate the payout date along with the total profits.

How risky did I want to be?

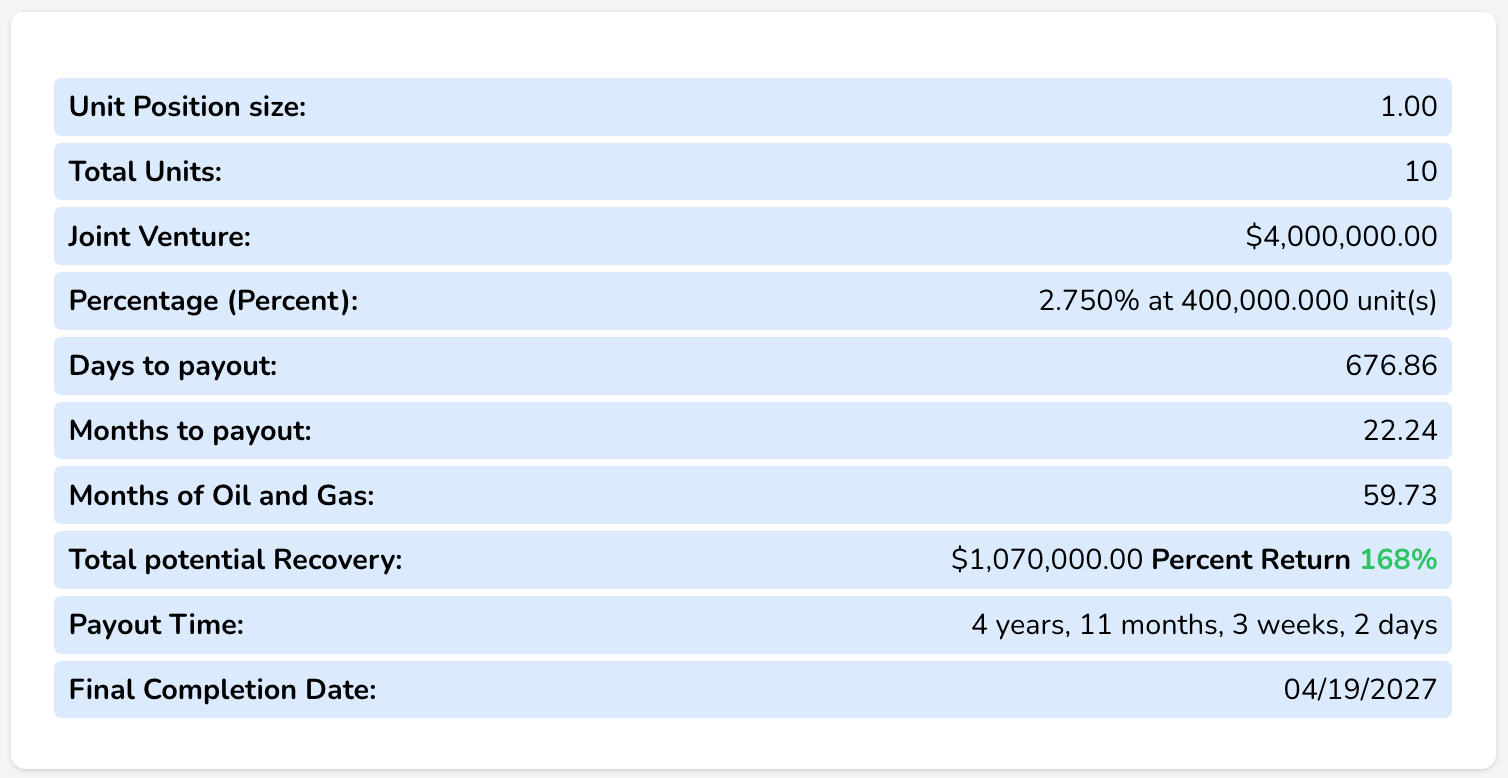

The oil and gas calculator will display the total production payout based on a Joint venture along with the time to deplete an Oil Well. There is a certain amount of risk involved in oil wells as they can run dry much sooner than predicted, but the potential for profit is dependent on the lifespan and production of the well.

Risk will determine the decision to invest

Will calculations provide enough data to determine the elements of risk and benefits when investing in oil and gas? Knowing the risks involved and potential profits is often on the lips of every investor who gambles at the idea of an Oil and Gas investment. This oil and gas calculator converts an initial investment into a countdown prediction of when that investment will payout. This simple conversion will show the total production payout based on a Joint venture and then show the time to deplete an Oil Well.

How many barrels of recoverable oil can be produced?

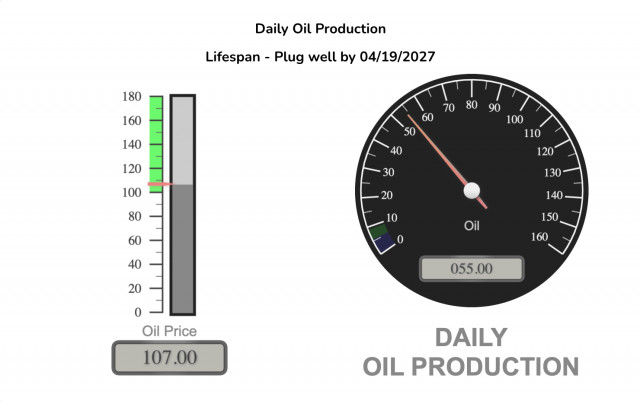

What are the daily production numbers, oil price, and recoverable oil? Calculating these numbers against time by assessing the potential gains is my method to predict or guess future outcomes.

The price of oil is multiplied against the daily production to show the daily revenue. Recoverable Oil is divided by the Daily production to estimate the time to deplete the well. Monthly operating costs are deducted based on the investment position size for the joint venture. Remember to adjust or account for expenses, land acquisition, royalties, etc., to get a more accurate projection for a return on your investment.

How to use this oil and gas calculator

The oil and gas calculator is easy to use. When you fill in your initial investment, Oil Recovery, Price, and daily production, it’ll automatically fill in the appropriate values. One of the things you’ll need to input is the Joint Venture capital needed for drilling a well. After that, you can adjust how much oil or natural gas you can extract from your project per day. It also estimates my portion of the monthly operating cost involved by unit. The calculator doesn't consider some of the risks of investing in oil and gas properties. For example, if there are any problems with downtime or maintenance that could affect your investment.

Oil and Gas Investments

How much money are you willing to invest?

How many years of crude oil are in the investment opportunity?

This calculator will help answer these questions. Calculate an investment amount to find the profit earned over time based on the total recovery outcome. Determine production and price to calculate the anticipated rate of return. Oil and gas production for the anticipated rate will show monthly cash flows within the oil investing calculator. Once those two pieces of information are in place, the calculator will automatically calculate your monthly cash flow and the potential return on investment (ROI). These numbers will vary based on several factors, like the market price of oil and gas or if there are any tax breaks involved. However, it’s a good starting point when deciding on whether or not to invest in oil and gas Joint Ventures. The opportunity for Long-term RO Quality oil and gas investments may provide investors with tax benefits and a passive income for years to come.

Investment advice with tax benefits

What kind of oil investing fits your criteria? Many investors also prefer to invest in mutual funds, but the are typically taxed at the higher ordinary income tax rate. One of the most common mistakes with oil and gas investments is overestimating potential returns. Often, people believe they will see an annual return of 30% for their investment. In 2022, the short-term outlook in March for oil prices averaged $117 per barrel; that estimate during that period, on those potential returns, has more than doubled for anyone investing in oil production since 2020. Knowing these numbers can help make a more educated decision about how much money you want to spend on your investment. Please consult a CPA or accountant familiar with the tax benefits from Oil and Gas investments. This calculator is for demonstration and example purposes only. Calculations are not to be used as investment advice or to guarantee an anticipated rate of return or cash flows. The example purposes do not account for all possible oil and gas outcomes.

- Taxes: Tax benefits

- Tangible and intangible drilling costs and money for drilling equipment are 100% deductible but must be depreciated over seven years.

- Lease operating costs and all administrative, legal, and accounting expenses can also be deducted over the life of the lease.

- Market segment specialization program https://www.irs.gov/pub/irs-mssp/oilgas.pdf

Gas company tax benefits in the gas industry. The 2017 Tax Cuts and Jobs Act helped oil companies further by reducing the effective tax rate for companies to 21% from 35%. Oil companies also receive subsidies because oil is a vital commodity to the gas industry.

A strategy for accredited investors

Demand for capital for any project relies on market calculations. Business participation with a certain amount of shared risk will ensure that company cares for the money invested in that project. A company will balance risk with the same amount of benefit. The involved risk of shared capital is a factor to consider when choosing a project.

Is that other business or company project taking a similar risk with their funds?

Would you invest money if the venture gives up all working interest?

The managing partner should do the same if accredited investors place a certain amount of financial risk into the production. Their combined vested interest would align with the same strategy, period. Measure the company by how they benefit from future production revenues.